It makes for good political stew if you can say that the rich aren't paying their fair share. You can boil up a sense of lack of justice, informed by nothing, but driven by rhetoric. The rich need to pay more. How much more? I don't know, just more. And if the rich really were somehow not paying their fair share, I'd jump right on that bandwagon. So lets start by proposing a metric for fairness, and analyzing how fair our system of government is... lets see if the rich are getting back more from the government more than they put in.

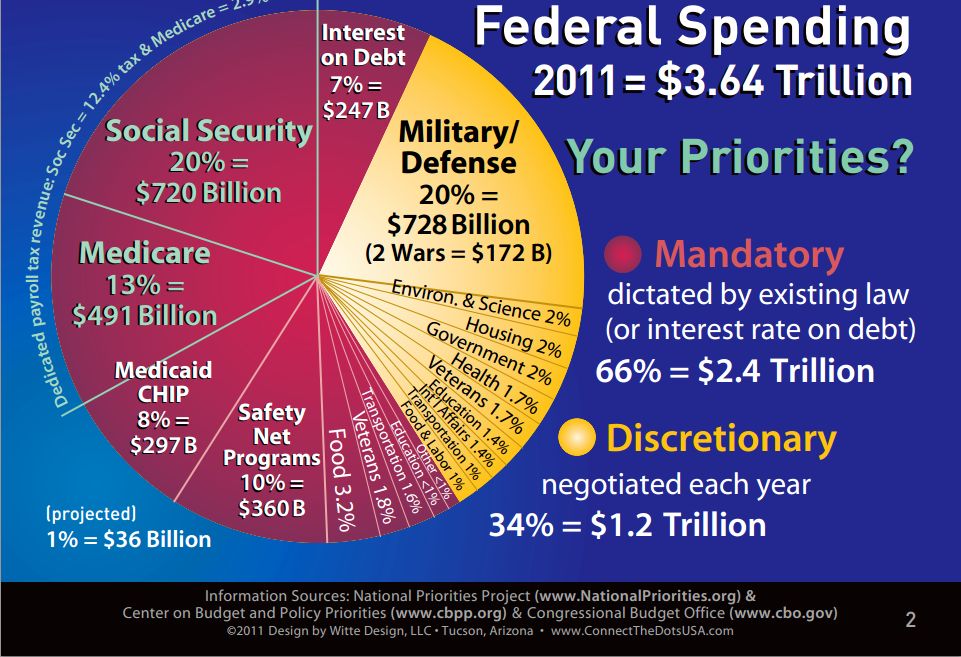

On the spending side, we can group spending into several major categories... the big ticket items are Social Security, Medicare, Medicaid, Interest on the debt, Military, and then a bunch of smaller discretionary programs. Lets consider the big ticket items...

The first 20% of the budget is Social Security, paid for primarily via payroll taxes. The CBO scores social security as a progressive program, noting that the highest quintile earners gets 60 cents back for every dollar they put in, while the lowest quintile receives two dollars for every dollar they put in.

Medicaid and the safety net programs make another 18% of the budget, but they have strict eligibility requirements. Wealthy Americans are ineligible to receive these benefits, which requires participants make no more than 133% of the poverty line.

Medicare makes up 13% of the budget... this is healthcare for the elderly. Eligibility requirements are determined by age, so there is nothing especially progressive about that. The wealthy are charged higher premiums on part B services that they, and as of this year are charged a higher rate on payroll taxes than most workers. Starting in 2013, the payroll tax itself will be rising on wealthy income earners from the 2.9% we all pay to 3.8%, as part of the Affordable Healthcare Act. I might argue that patient costs are largely income agnostic, so by paying a percentage of income for a fixed cost service naturally lends to a progressive model.

Interest on the debt makes up 7% of the debt, and its a rising percentage. It reflects the shared burden we have on previous budgets, which were equally progressive in their spending. Thus, the responsibility to pay old debt reflects the overall progressiveness of the budget.

The last big piece is military spending, making up 20% of the budget. There is nothing inherently progressive about this spending... but most of that budget goes directly to operations and personnel. These costs are about projecting power abroad, and the benefit we gain is shared. A cynical view might argue that a majority of foreign military spending is to secure low energy prices, but even then, energy costs disproportionately make a higher percentage of personal spending for lower income earners, and thus the benefit helps them more.

The remaining costs of government go to programs like transportation, veterans benefits, subsidized houses, student grant programs, and so forth. I would admit there is a good deal of corporate welfare in the system, but the primary benefactors of all these programs tend to be towards lower income Americans.

So we've managed to outline where most of the money gets spent, and it is fairly obvious that the vast majority of spending is progressive in nature. But when we consider the revenue, we recognize that it is also extremely progressive in nature. The top 10% of income earners contribute more than 55% of the revenue pie. They don't just pay their fair share, they shoulder the burden of taxes, and receive much less back in return.

This circles back to my original thoughts... what we have here is a system that isn't about fairness, but about compassion. And that is not a bad thing. We ask the wealthy to do more than their fair share to help our fellow citizens at the bottom obtain a higher standard of living. In this frame, we can ask how compassionate does our system need to be? Can we rationally speak about how the burden should be shared, given our understanding of who puts what in and who takes what out? Can it be free from jealousy of the wealthy, and the artificial injustice about what they contribute? The burdens of government should truly be a shared burden for all of us. I think we must be prepared to raise taxes on ourselves whenever we ask the wealthy to carry an even heavier burden. It is the fair thing to do.

No comments:

Post a Comment