Wednesday, January 23, 2013

I.O.U.S.A.

I think this is a film everyone should take the time to see. It captures the seriousness of our country's financial woes in a way that can shake you awake. The full version is available on netflix streaming, but if you want a condensed version, it is available here on youtube. GO SEE THIS FILM.

Monday, January 21, 2013

Fair or Compassionate

A good friend brought up a memory of a few years back that I'd like to share, because I think it sheds light on my view of the progressive taxation debate that just concluded in congress. We were working at a company that was in the process of restructuring its health care benefits, as many companies were forced to do in the face of rising health care costs. Our company had an odd demographic mix, with a large bulge of younger workers in their twenties, largely fresh out of college, and a large bulge of older workers nearing retirement. The new plan being proposed involved a substantial jump in costs for everyone, but especially for the younger workers. When the young guys started grumbling, our VP got up in front of the group and told us that the older guys with families, a group with much larger health expenses, were expected to pay so much more out of pocket for their benefits... and to make it more fair, they were distributing some of those costs back to us in order to make it "more fair". After relaying this episode to me, my friend turns to me and says, "really it wasn't that they were trying to be more fair, but that they were trying to be more compassionate." This is a point that has stuck with me.

It makes for good political stew if you can say that the rich aren't paying their fair share. You can boil up a sense of lack of justice, informed by nothing, but driven by rhetoric. The rich need to pay more. How much more? I don't know, just more. And if the rich really were somehow not paying their fair share, I'd jump right on that bandwagon. So lets start by proposing a metric for fairness, and analyzing how fair our system of government is... lets see if the rich are getting back more from the government more than they put in.

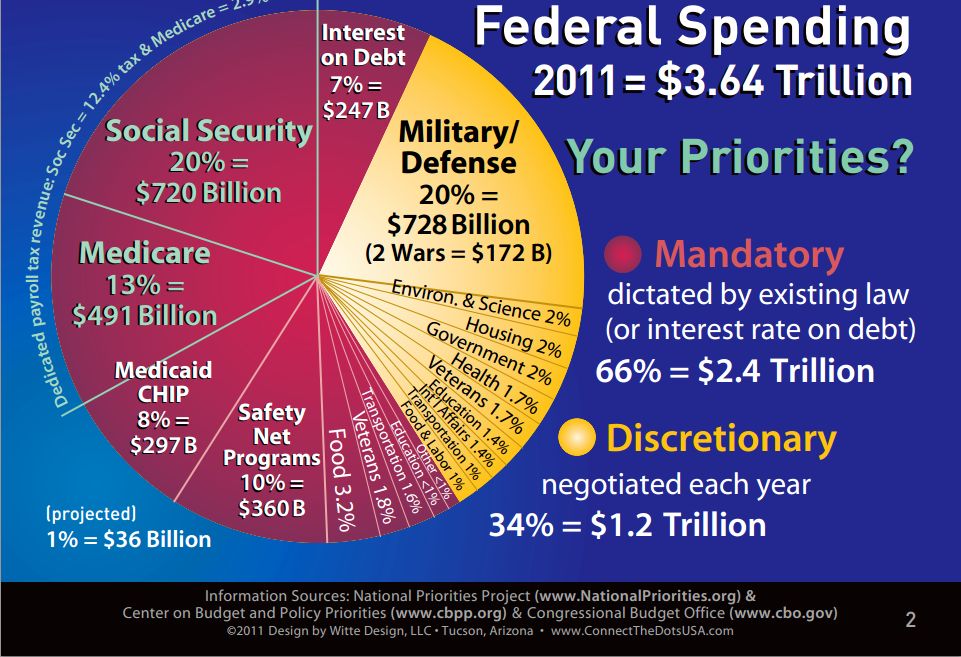

On the spending side, we can group spending into several major categories... the big ticket items are Social Security, Medicare, Medicaid, Interest on the debt, Military, and then a bunch of smaller discretionary programs. Lets consider the big ticket items...

The first 20% of the budget is Social Security, paid for primarily via payroll taxes. The CBO scores social security as a progressive program, noting that the highest quintile earners gets 60 cents back for every dollar they put in, while the lowest quintile receives two dollars for every dollar they put in.

Medicaid and the safety net programs make another 18% of the budget, but they have strict eligibility requirements. Wealthy Americans are ineligible to receive these benefits, which requires participants make no more than 133% of the poverty line.

Medicare makes up 13% of the budget... this is healthcare for the elderly. Eligibility requirements are determined by age, so there is nothing especially progressive about that. The wealthy are charged higher premiums on part B services that they, and as of this year are charged a higher rate on payroll taxes than most workers. Starting in 2013, the payroll tax itself will be rising on wealthy income earners from the 2.9% we all pay to 3.8%, as part of the Affordable Healthcare Act. I might argue that patient costs are largely income agnostic, so by paying a percentage of income for a fixed cost service naturally lends to a progressive model.

Interest on the debt makes up 7% of the debt, and its a rising percentage. It reflects the shared burden we have on previous budgets, which were equally progressive in their spending. Thus, the responsibility to pay old debt reflects the overall progressiveness of the budget.

The last big piece is military spending, making up 20% of the budget. There is nothing inherently progressive about this spending... but most of that budget goes directly to operations and personnel. These costs are about projecting power abroad, and the benefit we gain is shared. A cynical view might argue that a majority of foreign military spending is to secure low energy prices, but even then, energy costs disproportionately make a higher percentage of personal spending for lower income earners, and thus the benefit helps them more.

The remaining costs of government go to programs like transportation, veterans benefits, subsidized houses, student grant programs, and so forth. I would admit there is a good deal of corporate welfare in the system, but the primary benefactors of all these programs tend to be towards lower income Americans.

So we've managed to outline where most of the money gets spent, and it is fairly obvious that the vast majority of spending is progressive in nature. But when we consider the revenue, we recognize that it is also extremely progressive in nature. The top 10% of income earners contribute more than 55% of the revenue pie. They don't just pay their fair share, they shoulder the burden of taxes, and receive much less back in return.

This circles back to my original thoughts... what we have here is a system that isn't about fairness, but about compassion. And that is not a bad thing. We ask the wealthy to do more than their fair share to help our fellow citizens at the bottom obtain a higher standard of living. In this frame, we can ask how compassionate does our system need to be? Can we rationally speak about how the burden should be shared, given our understanding of who puts what in and who takes what out? Can it be free from jealousy of the wealthy, and the artificial injustice about what they contribute? The burdens of government should truly be a shared burden for all of us. I think we must be prepared to raise taxes on ourselves whenever we ask the wealthy to carry an even heavier burden. It is the fair thing to do.

It makes for good political stew if you can say that the rich aren't paying their fair share. You can boil up a sense of lack of justice, informed by nothing, but driven by rhetoric. The rich need to pay more. How much more? I don't know, just more. And if the rich really were somehow not paying their fair share, I'd jump right on that bandwagon. So lets start by proposing a metric for fairness, and analyzing how fair our system of government is... lets see if the rich are getting back more from the government more than they put in.

On the spending side, we can group spending into several major categories... the big ticket items are Social Security, Medicare, Medicaid, Interest on the debt, Military, and then a bunch of smaller discretionary programs. Lets consider the big ticket items...

The first 20% of the budget is Social Security, paid for primarily via payroll taxes. The CBO scores social security as a progressive program, noting that the highest quintile earners gets 60 cents back for every dollar they put in, while the lowest quintile receives two dollars for every dollar they put in.

Medicaid and the safety net programs make another 18% of the budget, but they have strict eligibility requirements. Wealthy Americans are ineligible to receive these benefits, which requires participants make no more than 133% of the poverty line.

Medicare makes up 13% of the budget... this is healthcare for the elderly. Eligibility requirements are determined by age, so there is nothing especially progressive about that. The wealthy are charged higher premiums on part B services that they, and as of this year are charged a higher rate on payroll taxes than most workers. Starting in 2013, the payroll tax itself will be rising on wealthy income earners from the 2.9% we all pay to 3.8%, as part of the Affordable Healthcare Act. I might argue that patient costs are largely income agnostic, so by paying a percentage of income for a fixed cost service naturally lends to a progressive model.

Interest on the debt makes up 7% of the debt, and its a rising percentage. It reflects the shared burden we have on previous budgets, which were equally progressive in their spending. Thus, the responsibility to pay old debt reflects the overall progressiveness of the budget.

The last big piece is military spending, making up 20% of the budget. There is nothing inherently progressive about this spending... but most of that budget goes directly to operations and personnel. These costs are about projecting power abroad, and the benefit we gain is shared. A cynical view might argue that a majority of foreign military spending is to secure low energy prices, but even then, energy costs disproportionately make a higher percentage of personal spending for lower income earners, and thus the benefit helps them more.

The remaining costs of government go to programs like transportation, veterans benefits, subsidized houses, student grant programs, and so forth. I would admit there is a good deal of corporate welfare in the system, but the primary benefactors of all these programs tend to be towards lower income Americans.

So we've managed to outline where most of the money gets spent, and it is fairly obvious that the vast majority of spending is progressive in nature. But when we consider the revenue, we recognize that it is also extremely progressive in nature. The top 10% of income earners contribute more than 55% of the revenue pie. They don't just pay their fair share, they shoulder the burden of taxes, and receive much less back in return.

This circles back to my original thoughts... what we have here is a system that isn't about fairness, but about compassion. And that is not a bad thing. We ask the wealthy to do more than their fair share to help our fellow citizens at the bottom obtain a higher standard of living. In this frame, we can ask how compassionate does our system need to be? Can we rationally speak about how the burden should be shared, given our understanding of who puts what in and who takes what out? Can it be free from jealousy of the wealthy, and the artificial injustice about what they contribute? The burdens of government should truly be a shared burden for all of us. I think we must be prepared to raise taxes on ourselves whenever we ask the wealthy to carry an even heavier burden. It is the fair thing to do.

Saturday, January 12, 2013

Budget Hero

The great sword of the United States government is the power of the purse. We can wield that sword to attack poverty, safeguard the environment and elderly, and project power across the world, among many other pursuits. And we share that burden through revenue raised on individuals and corporations. It is so important, this power, that I believe it has become the fundamental divide in American politics. What should we spend money on? How are we going to pay for these programs?

But there is a fundamental flaw here... the American public is largely unprepared for this debate due to a lack of education about where we are at. Most Americans don't know how we spend our money. They may know they would be hard pressed to get a credit card with a 50,000 dollar limit, but I'd bet they'd be shocked to know the credit limit the Federal Government has issued them and spent on their behalf is much higher than that. They don't understand that our education system is mostly paid for by state and local government, not the federal government. They wouldn't know that entitlement programs make up more than half the budget. They also don't know how we pay for it. They don't know how mandatory payroll taxes are taken out of our paychecks. They don't know how the tax burden is currently distributed. They don't know that for every dollar they pay in taxes, the government is borrowing another 64 cents that they are expected to pay later.

And the problem is, this leads to simplified arguments. We hear politicians say "rich people need to pay their fair share", and we echo back "they should pay more", but when we ask them what a rich person's fair share is, they quote a tax rate lower than what the rich currently pay. When Jerry Brown was mayor of Oakland, he was exasperated when Oakland residents passed a ballot measure to increase the number of cops on the street, and then shot down the measure that would have paid for the added cops. There really is no way to sensibly govern when rational analysis isn't a part of the equation.

So what do we do? Well I think that young American's need to be better prepared to understand the crux of the spending and taxing issues they will vote on later in life. We all remember the civics and economics classes we took in high school, right? They focused on the theory of how our government works... a house and senate, a supreme court, separation of powers... supply and demand curves... but nothing said about how the government appropriates budgets. Nothing practical, about the history of how our budgets and taxes look. Nothing to prepare us to consider future generations. And this needs to change.

I think students should be first allowed to construct their own governments, with their own houses or senates or parliaments or whatever... then make their own budgets and set up their own taxation system, all with tools that model reality and long term outlooks. Then teachers come back to show our history of how its done. Maybe even the history of how its done elsewhere in the world. Then they should analyse the consequences of their original choices, as well as the choices that were really made by our government. And then they should build a budget again. This kind of exercise is the kind of thing that can have a life long impact on people. When they consider how they vote, they can compare their own values which they've already analyzed to what the politicians are promising. And they can make rational decisions.

I also believe there is a great tool out there already, called budget hero. Its a simple game that lets you take actions to change the current budget, and see how it plays out over time. It is a good start towards the type of system that could engage young Americans in that impacting kind of way. I encourage you to play around with it... see what kind of system you would come up with... and compare that to other demographic groups out there. Its another step we can take towards improving how our government works.

Saturday, January 5, 2013

The CALM Act, and the fiscal cliff negotiations

I'd like to give a shout-out to Joe Manchin, Democratic Senator from West Virginia, for introducing the CALM act in the midst of the fiscal cliff tax talks. While it wasn't adopted, the idea of phasing in the tax increases over three years could have helped avoid recession while returning the tax rates to Clinton levels. I am a strong believer that broad based taxes both better address long term debt, and are a more fair mechanism for sharing the burdens of government. While Manchin admitted it was perhaps the best of a bunch of unpalatable choices at the time, I would have supported it.

I think that the agreement that was reached can best be explained by its political maneuvering. The Obama administration was largely more interested in producing a more progressive taxation system than it was in dealing with the national debt, at least while republicans hold the house. They also are more satisfied with the structure of the current scheduled spending cuts, which reduce military and discretionary spending by 10%, while leaving entitlements untouched. By decoupling the spending and tax negotiations, the talks turned from a grand bargain addressing the debt problems to a debate about how progressive taxes should be made. Since revenue increases were the republicans primary leverage in grand bargain talks, addressing that issue first puts the administration in a much stronger position in the coming spending cut talks.

The only point of leverage republicans have left is the debt ceiling... which the president has repeatedly claimed he won't negotiate with. Without that, I'd anticipate the administration would largely press for a reduction from the scheduled 10% cuts to discretionary spending. I'd encourage republicans to press for either another dollar for dollar extension of the debt ceiling to cuts ratio, or to negotiate an extension to the debt ceiling by shifting some of the debt cuts to the long term structural entitlement reforms.

Subscribe to:

Comments (Atom)